how to pay philadelphia property tax

Philadelphia assesses property at 100 of current market value. Before you start To find and pay property taxes.

Billy Penn Property Taxes Are Going Up Again For Many Neighborhoods With The Biggest Jumps In Mid Northeast And Southwest Philly Https Www Philly Com News Philadelphia Tax Increase Property Assessment Philadelphia Real Estate Opa 20190411 Html

Pay Make a Payment TAXES BEFORE YOU START You may need the following information before you pay online.

. Makes it easy to pay City of Philadelphia real estate taxes and other bills using your favorite. Select a location on the map Click or tap on a specific property to view details about it. To pay your taxes or discuss your tax account contact.

Theyre commonly paid biannually twice a year or yearly. Makes it easy to pay City of Philadelphia real estate taxes and other bills using your favorite debit card credit card or electronic check. New owners are now compelled to pay the tax.

Visit the Department of Revenue How to file and pay City taxes page. To pay the Philadelphia Property Tax with E-check select the option and click on Continue. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances.

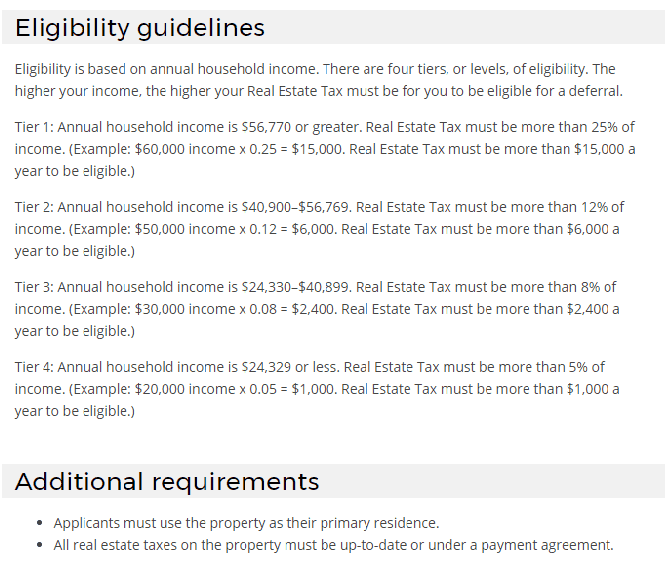

Get a property tax abatement Guidelines for determining which Real Estate Tax abatements you can get for your property. If you experience any problems with this telephone system please contact customer service at 800. Typically its not a prorated tax remittance paid.

To pay online you will need to create an account with the Philadelphia Revenue Department. Penalties and interest as well as attorneys fees continue to accrue until the tax is paid. Then we accept the Terms and Conditions of the Page click on Accept.

To get started you can. Choose options to pay find out. City of Philadelphia Revenue Department.

The average property tax rate in Philly is 099 so you might want some help with paying property taxes. We begin to fill in the fields. Property taxes are not collected on a monthly basis.

To pay your Philadelphia property taxes you can either pay online or by mail. Search on property information Type an address property account number or. Review the tax balance chart to find the amount owed.

The Current Year Installment Plan takes your. Realty Transfer Tax Requirements and rates. Concourse Level Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600.

The City of Philadelphia has a program that lets you pay your annual property tax bill in affordable monthly payments and any interest or penalties on the taxes will be forgiven by the City if you. File andor pay your taxes online. From that point of exchange purchasers reimburse former owners on a pro-rata basis.

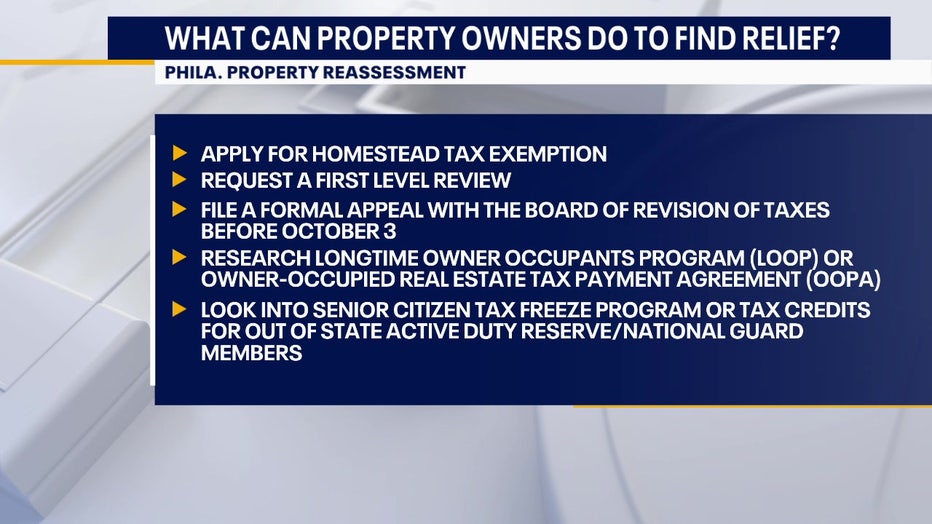

Property tax appeals and exemptions are a good place to start. Enter the address or 9-digit OPA property number. Philadelphia assesses property every year to determine market value based on numerous factors including the size location.

You can pay your Real Estate Tax by credit card over the phone by calling 877 309-3710. File and pay Beverage Tax File and pay Earnings Tax employees Pay or file Liquor Tax File and pay Outdoor Advertising Tax File and pay Parking Tax File and pay Valet. Pay City of Philadelphia Real Estate Taxes and Other Bills Online and On Time ACI Payments Inc.

Federal Entity Identification Number EIN or your Social Security Number SSN. Is it necessary to pay property taxes on a monthly basis.

Philadelphia Commercial Owners File Property Tax Lawsuit Ke Andrews

Center City District Ccd Assessments

Pennsylvania Property Tax H R Block

How Philadelphia Homeowners Can Confirm Property Assessments

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Philadelphia Property Tax Assessments Going Out After Delay Whyy

4 Ways To Pay Less Property Tax In Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

Pay Your 2022 Property Tax By March 31 Department Of Revenue City Of Philadelphia

Big Change To Widely Used Property Tax Program Now Philly Law Related Relief Measures To Follow Local News Phillytrib Com

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Philadelphia Department Of Revenue Philadelphia Pa Facebook

Philly 10 Year Tax Abatement To Shrink Under Domb Bill Whyy

Now Open Property Tax Payment Plans Department Of Revenue City Of Philadelphia

Philadelphia S Ranking For Property Tax Rate Philadelphia Business Journal

New Changes In 2022 City Real Estate Tax Bills Allentownpa Gov

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Philadelphia Again Extends Deadline For Property Tax Reviews Local News Phillytrib Com

Reminder Property Tax Assessment Appeal Deadline For Philadelphia Is October 4 Klehr Harrison Harvey Branzburg Llp